Compare Motorbike Insurance

51% of bikers pay less than £195*

51% of bikers pay less than £195* Compare quotes from 25+ brokers

Compare quotes from 25+ brokers All motorcycle styles, makes & models

All motorcycle styles, makes & models One quick and simple online form

One quick and simple online form

Compare motorbike insurance quotes for all levels of cover, policy types, and licences.

We're an independent, unbiased and privately owned UK business. Get a quote now and see how much you could save.

Compare bike insurance from 25+ UK experts

Motorbike insurance quotes from FCA regulated brokers

All manufacturers, models & bike styles

From Aprilia to Yamaha, Scooter to Superbike.

One quick form - only takes a few minutes

Enter your details once to compare multiple bike quotes

Compare insurance for your motorbike today

Quote and buy online. Get covered, fuss free.

Motorcycle insurance comparison

Why compare motorcycle insurance quotes at Biker Insure?

You could save money - 51% of bikers pay less than £195 for their motorbike policy*

We’re completely impartial - Compare motorbike insurance, tailored to you and your motorcycle. Quotes are based entirely on the details you give, without bias – simply choose the motorbike policy that’s best for you.

Fast, easy comparison - Comparing motorbike insurance quotes from FCA regulated brokers using the streamlined and user-friendly system takes just a few minutes.

We’re independent - Biker Insure is owned and run by a lifelong motorcycle enthusiast. We know first-hand how frustrating the motorbike insurance market can be.

Motorbike insurance - why you need it.

It's the law

If you use your motorbike on roads and in public places, it’s a legal requirement to have a motorbike insurance policy in place.

Unless your motorcycle is declared SORN, you’ll need to be covered by insurance at all times – even if you aren’t using the bike, or it’s in storage. This is called “continuous insurance enforcement”

You don’t need to insure your motorbike if it’s kept off the road and declared as SORN, but you can choose to do so. Some insurers offer a "laid up motorcycle insurance" policy for those wanting to insure a motorbike against accidental damage, fire and theft when off the road - but this is not compulsory.

For peace of mind

A motorbike insurance policy provides financial protection for accidents, injuries, or damage to property.

Depending on what level of cover is included in your motorcycle policy, you could be able to make a claim to help reimburse you for losses in the event of an accident or if your motorbike is stolen.

You can also add extras such as personal accident cover, legal protection, and helmet & leathers cover.

Compare motorcycle insurance: why it makes sense.

Whether you view motorbike insurance as a compulsory expense, a financial safeguard, or a combination of both, it's an inevitable aspect of life on two wheels.

In January 2022, the FCA banned motor insurers from charging existing customers more at renewal than they would expect to pay when taking out a new motorbike policy with the same insurer. This put an end to price walking, where new customers would be given a favourable deal on their motorbike insurance - before increasing the policy price in subsequent years.

The ruling doesn’t however mean that your renewal quote is the best deal. Different motorbike insurance brokers have different prices. Comparing the market allows riders to identify brokers offering the most affordable quotes or comprehensive extras, helping to choose a bike insurance policy to suit individual circumstances.

Using a motorcycle insurance comparison site can be more efficient and faster than obtaining quotes individually, because you only need to enter your details once. The policy information is presented in a clear and organised manner which streamlines the process for quicker access to quotes from multiple insurers.

When comparing motorbike quotes, you may also discover advantageous offers from brokers that would otherwise be overlooked, forgotten, or were previously unknown to you.

What types of motorbike policy are compared, and what is included?

When comparing motorbike insurance quotes, you can choose from three different policy types:

- Third Party Only (TPO)

- Third Party Fire & Theft (TPFT)

- Fully Comprehensive (Fully Comp)

Each tier of motorbike insurance includes all the coverage from the previous level. With each step up the hierarchy, an additional layer of coverage is added.

Third Party Only Motorbike Insurance

The legal minimum requirement in order to ride a motorcycle on UK roads. This is the most basic level of motorbike insurance, and provides the minimum level of protection.

Riding with Third Party Only motorbike insurance means that your insurer will cover any losses to other people or road users. If you are involved in an accident when riding your motorcycle and cause injury or damage to someone else – whether that be a person, a vehicle, or property, Third Party Only insurance protects other people by providing financial compensation to them in the event of a loss.

It also means that claims from a third party (which can be many, and very expensive) made against you are paid for by the motorbike insurance company, rather than you personally.

With Third Party Only, you won’t be covered if your bike is stolen, or for any accident damage that is your fault – whether because you hit a patch of ice, got a corner wrong, or overbalanced on a gravelly gradient.

No cover will be provided for any loss of earnings as a result of an injury, or for any health care or physiotherapy that may be necessary.

If you are involved in a bike accident that wasn’t your fault, you’ll need to recover your losses from the other party. This will mean proving that the accident was caused by them (or by getting an admission of fault).

Third Party Fire & Theft Motorbike Insurance

The middle level of motorbike cover available. Third Party Fire & Theft motorbike insurance incorporates everything covered by Third Party Only, but with the addition of theft insurance cover. If your motorbike is stolen, your insurance company should pay out the market value (minus any excess) of your motorcycle, so you can replace the bike with a similar machine.

As the name suggests, you’ll also be insured in the event of your bike catching fire and being damaged beyond repair.

As with TPO, TPFT provides cover for everyone else involved in an accident, but not insurance cover for you.

Fully Comprehensive Motorbike Insurance

The highest level of insurance cover available, fully comprehensive motorbike insurance includes everything covered by TPFT and TPO, but also additional protection for accidents that are your fault.

Your motorbike insurer could pay for costs incurred by the third party, plus your own losses. Fully comprehensive motorbike insurance can also pay for damage caused in accidents where nobody else is involved, whether because of rider error, inclement environmental factors, or poor road conditions.

A comprehensive policy may also cover your bike against other accidental damage, even if you aren’t riding it – such as from flooding or other environmental risks – but check your individual policy wording.

Fully comprehensive motorbike cover typically includes riding other bikes on a Third Party Only basis – but again, check with your provider.

It’s easy to change between cover types in the comparison journey – enabling you to see at a glance how each level of cover impacts the overall cost of your motorbike policy.

What isn’t usually included in a standard motorcycle insurance policy?

The extent of cover provided by different motorbike insurers can vary, so always check your policy wording.

Examples of common exclusions on a standard motorbike insurance policy could include:

Riding under the influence

Riding whilst under the influence of drink or drugs is illegal, and dangerous. Unsurprisingly if you’re involved in a motorbike accident whilst under the influence, you won’t be covered by your motorbike insurance.

Intentional damage

It might be unthinkable that any biker would ever intentionally damage their pride and joy. But if you (or anyone on the policy) deliberately damage your bike, you won’t be covered.

Sidecars

A sidecar is classed as an accessory, or included as a part of the entire vehicle depending on how the sidecar has been built.

Sidecar policies can’t be compared at Biker Insure. For sidecar kits, self-build or outfitted sidecars you’ll need to find a specialist insurer.

Wear and tear

Motorbike insurance doesn’t cover general wear and tear to the vehicle. Stone chips, scratches, dents, rust and other damage caused by everyday riding are not usually included.

More obviously, consumables such as tyres, brake pads, chain and sprockets are not covered under a standard motorcycle insurance policy.

Negligence

Claims that are caused due to negligence will not usually be covered. For example, if your bike is stolen because you have left keys in the ignition.

Track days

Most policies will specifically exclude track use. You don’t legally need insurance to use your bike on a track, but you won’t be covered if you sustain an injury or if you damage the motorbike.

Track day insurance can be bought individually from some specialist motorcycle insurance brokers. Biker Insure has partnered with Bikesure who can offer track day cover from as little as £67. Their best deals are available over the phone by calling 0800 587 2944

Racing

Racing or competitive bike sport isn’t included. You’ll need to find a specialist insurance provider if you want to be covered for racing. This is different to track day cover, which is technically non-competitive because racing is not permitted on a track day.

Punctures

Punctures aren’t included as part of a standard motorcycle insurance policy. You can usually add motorbike breakdown as an extra, or make sure you’re covered on a separate breakdown policy for your bike.

Pillions

Passengers aren’t included as standard on all motorbike policies. If you’re riding with someone on the back, you’ll need pillion cover. Be sure to tick “yes” on the comparison form for the question “will you ever carry a pillion passenger” if this is the case.

Modifications

Modifications are non-standard changes made to the motorcycle after manufacture – such as aftermarket exhausts, dyno jet kits, tail tidies etc. You must declare any performance enhancing or cosmetic modifications to your insurer.

Check your policy terms and conditions. Although some brokers include common modifications as standard, if you have not declared a modification and you make a claim, then your claim may be rejected and your insurance void.

You can select from well over 100 modifications on the comparison form. Add as many as you like.

You don’t need to include “optional extras” that were added by the manufacturer when the bike was built.

How much does motorbike insurance cost?

51% of bikers pay less than £195 using the comparison system available at Biker Insure*

The amount you are quoted when comparing motorbike insurance varies depending on the answers you give to questions on the comparison form. Factors affecting your motorbike insurance quote include:

Your motorbike

The make, model, type of motorcycle, it’s engine size and power output can affect your quotes. Generally speaking, more powerful and valuable motorcycles will cost more to insure. Insurance for a 125cc motorbike will tend to cost considerably less than quotes for a superbike, for example.

Your age

Older riders will tend to have access to cheaper premiums than young riders or learners. It’s not a linear relationship, and the very old or very young will often pay more. Insurers also account for:

Claims & riding history

If you’ve been riding for a long time with no points or convictions and have built up a good no claims history, you’ll usually pay less.

Where you live

If you live in a high crime postcode or area with high rates of motorcycle theft, your quotes will usually be more expensive.

Your job

Some occupations and job titles can be seen as riskier than others.

Modifications

Insurance for non-standard bikes can be more expensive. Some common modifications like exhausts might not affect the cost of your insurance, whereas something more extreme like a nitrous oxide kit could be seen as a riskier bet.

Annual mileage & bike use

The more miles you cover, the higher the risk to the insurer. If you only cover 3000 miles a year on a social basis, you’ll be a lower risk than a rider racking up 15,000 miles for social, commuting, and business purposes.

Level of cover

Comprehensive cover isn’t always cheaper than TPO or TPFT. Compare how each option changes your quotes, and make sure you choose the cover that’s right for you.

Excess

You can usually add an amount for your voluntary excess (usually up to £500), which is on top of any compulsory excess on the policy. If you’re prepared to pay more towards any claim, it’s a signal to the insurer that you could be less of a risk.

Security and where the bike is stored

Bikes kept in garages typically command lower premiums. Some insurers may also give additional discounts for bike security measures such as ground anchors, alarms and Data Tagging.

Price sensitive questions are highlighted on the motorbike quote comparison journey.

Find more information on how to get cheaper motorcycle insurance.

Motorbike usage classes

When comparing, you’ll be asked how you’re going to be using your motorcycle. There are 5 categories for you to choose from:

Social only (also known as social, domestic and pleasure) - day to day riding for leisure and social purposes, but not including to and from a place of work.

Social & Commuting - day to day riding, including to and from a permanent place of work. This may not include any journeys that you might make whilst at work, such as riding to a client's office.

Business Use (by the proposer) - to and from a permanent place of work plus any journeys that you might make while at work, such as driving to a client's office. It will also cover Social use.

Business Use (proposer and named riders) – as above, but also includes any named riders on the policy for business use.

Delivery Use (also known as class 3 business motorbike insurance) - this covers the main rider for use of the bike while working as a courier, or delivering low-cost goods such as food and parcels.

Check the policy wording carefully, making sure you have the right cover for how you use your bike.

Licence types

There are different types of UK motorcycle licences. You can compare insurance for a motorbike, whichever licence type you have. Follow the links for further information:

- A – The full, unrestricted motorbike licence

- A1 motorcycle licence*

- A2 motorcycle licence*

- AM – Moped licence

- Provisional motorcycle licence – you can ride bikes up to 125cc on a provisional licence as a learner rider after completing your CBT, whilst displaying L plates.

*If you have an A1 or A2 licence, please select the “Full UK Motorcycle” licence option

Motorcycle policy extras and options

Some motorbike insurers may include various extras depending on the level of cover you have selected, either as part of a promotion or as standard. Most of the time, you’ll need to pay more.

The comparison quote results page allows you to check which extras are included in the policies you’ve just compared, plus the price for adding each one if it’s not included.

You can choose to add the following extras when you’ve received your motorbike insurance quotes. The total policy price will then be amended to include the extras.

Please note: although the system will compare prices for optional extras, you may need to add these on to your bike policy on the insurers site before you purchase.

Policy extras you can compare:

Bike legal assistance

If you’re involved in a motorbike accident that’s not your fault and leads to a legal claim, you can get help in claiming back uninsured losses and legal costs.

Motorbike breakdown cover

Get back on the road quicker if you break down or something goes wrong with your bike.

Most breakdown policies include roadside assistance as standard, where a mechanic will come out to fix your motorbike where you’ve broken down. If they can’t fix it there and then, you’ll typically be transported with your bike to the nearest garage.

Some breakdown policies also include onwards travel, hotel accommodation, and alternative transport while your bike is being repaired.

Basic bike breakdown might not include cover if you break down at home so check what level of breakdown cover is included in your policy.

Helmet & leathers cover

Your riding kit is expensive. Arai’s and Alpinestars don’t come cheap! Because motorbike insurance policies don’t typically cover damage to your helmet or riding gear in an accident, helmet and leathers cover can be a useful addition to help cover the costs incurred.

Despite what the name suggests, helmet and leather insurance covers all your riding gear - including boots and gloves - whether they are made from leather, textile or any other material.

There is typically an upper limit on the amount you can claim. At the time of writing, Carole Nash and Bennetts have a £1500 claim limit, whereas Devitts have a £1000 cap.

Personal accident cover

Provides compensation in the event of serious accidental injury while riding your bike and you’re at fault. Policies can pay out for things like loss of limbs, disability and death.

Always check the policy wording for full details on any extras you add. Different brokers can have their own exclusions, conditions and limits attached to each additional level of cover.

Further optional upgrades or extras may also be available. You can’t compare prices for these, but you can add them on if available from your chosen insurer:

Riding abroad

If you’re planning a foreign motorbike tour, it’s essential to check if your policy includes this option for the country or countries you’ll be riding through. International motorcycle insurance usually provides cover for riding your bike in countries outside the UK for a maximum number of days, most typically for EU cover.

Key cover

Covers the cost of replacing your bike keys if they are lost, stolen or damaged.

What you need to compare motorbike insurance

1. Information about your motorbike - Specific information such as make & model including any modifications. Additional security you may use or have fitted, and how much your bike is worth.

2. Your details - Personal information about you such as where you live, your occupation, licence details and riding history.

3. Your cover - The level of motorbike insurance required (fully comp, third party fire & theft, or third party only). How you will be using the bike, your no claims discount and the amount of voluntary excess you wish to apply. Just a few more details plus the T&C’s and you’ll discover…

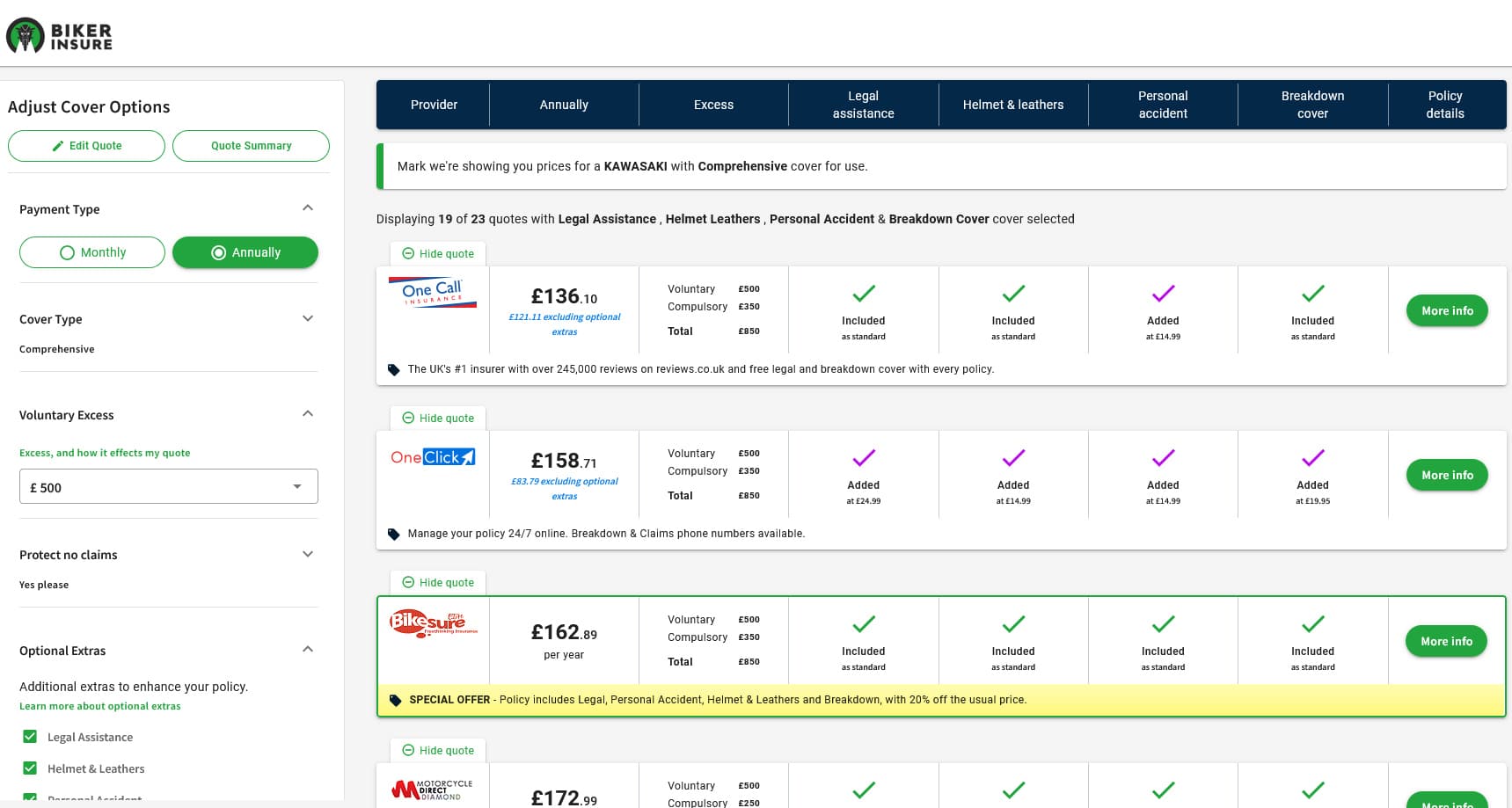

4. The quotes - You will be shown a list of motorbike insurance quotes, plus an excess amount. The motorbike insurance comparison will look something like this:

In this section, you'll also see any policy extras that are included in the quote. These extras include legal assistance, helmet & leathers cover, and personal accident insurance. If the extras don't come as standard, the cost to add them on to your policy will be shown (if available).

You can also find further details about each quote – such as who the underwriter is, and any special policy features – by accessing the “more details” tab.

Once you have decided which motorbike policy is right for you, your motorbike insurance purchase can be completed either online on the brokers website, or over the telephone.

How does motorbike comparison work?

When you compare quotes, the details you have provided are shared with multiple (25+) motorbike insurance brokers.

Each broker has a selection of underwriters they work with in the provision of motorcycle insurance policies. The underwriter provides a quote to the broker, who will then quote a policy price back to the comparison system.

There are essentially two layers of comparison happening simultaneously: brokers comparing underwriters, and comparison sites comparing brokers.

What you’ll usually see on the comparison results page is a list of the best prices each broker can achieve from their underwriters.

The entire comparison process, and the interaction between underwriters and brokers takes just a few seconds from the time you hit the quote button.

Can I compare multi-bike policies at Biker Insure?

Multi-bike is a form of motorbike insurance that makes it easier to insure two or more motorcycles on the same policy.

The system available at Biker Insure is not currently capable of multi bike comparison, however we have partnered with Bikesure who are experts in tailoring bespoke multi bike insurance policies. You can find more information on our multi bike insurance page.

Can I compare temporary motorbike insurance quotes?

The comparison system is for annual motorcycle policies only. If you only need to cover your motorcycle for a short period of time, we have partnered with Tempcover. Find out more on our temporary motorbike insurance page.

Why use Biker Insure and not one of the other motorcycle insurance comparison sites?

Biker Insure is a UK based motorbike insurance website. We’re independently owned and offer access to a completely unbiased motorcycle insurance comparison service. At Biker Insure you can compare over 25 UK based motorcycle insurance brokers, getting quotes from some of the biggest and best names (and some of the smaller guys too!) in the motorbike insurance market.

The secure, encrypted comparison system is free to use, completely impartial, and could save you money on your motorbike insurance.

At Biker Insure, it's our mission to help British Bikers save money on their motorbike insurance by providing access to a free, unbiased & simple to use motorcycle insurance comparison service

Compare motorbike insurance at Biker Insure today and see just how much you could save:

Motorcycle insurance comparison FAQ's

Can you compare motorbike insurance for delivery riders and couriers?

Yes. Select “delivery use” in the usage class section. Quotes will then be compared from brokers who can provide cover for couriers and delivery riders.

Can I compare classic motorcycle insurance?

Yes, you can compare classic motorcycle insurance at Biker Insure. Unless you have a particularly rare, unusual or unique classic, you should be able to compare quotes.

What kind of motorbikes can be compared?

Insurance for any make, model, and style of motorcycle can be compared – from superbikes to cruisers, adventure bikes to scooters, tourers to supermotos. From Hondas to Harleys, Kawasakis to KTM's.

Just enter your reg number and the motorbike will appear automatically. If you don’t know this, select the make and model of bike from the drop-down list.

Is Biker Insure the cheapest online motorcycle insurance website?

A motorbike insurance comparison site shouldn't claim to be the cheapest, unless the claim can be substantiated and verified. To avoid the marketing hyperbole, try to get quotes from as many independent comparison sites as you can.

Because the price of motorcycle insurance depends on a rider's individual circumstances, quotes will always vary from broker to broker, and between comparison websites.

Get a motorbike insurance quote today and see how the prices at Biker Insure compare.

Will I save money by comparing motorbike insurance?

The more quotes you get, the greater your chances of finding cheaper motorbike insurance. Whilst nothing in life is guaranteed, you'll certainly maximise the chances of reducing your annual motorbike insurance premium by comparing. And because it’s a completely free service, there really is nothing to lose.

Can I compare motorbike insurance if the bike hasn’t been bought yet?

Yes – just select “not purchased yet” in the vehicle details section.

If you’re looking to find out how much insurance is likely to cost for a motorbike you don’t yet own – or are shopping around for a new bike and need an idea of annual insurance costs, you can still get a quote without a reg number*. Simply find the make and model of motorbike you are interested in from the dropdown menus.

* Not all brokers will be able to quote without a reg number, so you might see fewer results than usual. Brokers that have been unable to quote due to no reg will be shown on the results page.

My motorbike has some modifications. Where can I declare these?

The quote form contains a comprehensive modifications section with well over 100 mods, where you can select any changes that have been made to your bike from standard.

What motorcycles are best on insurance?

Generally speaking smaller, less powerful, less valuable and older machines will cost less to insure.

To compare the insurance cost of different motorcycles, simply run several quotes and change the bike each time. That way, you’ll be able to see which motorcycles are the best on insurance for your individual circumstances.

Which motorcycles are most expensive to insure?

Fast, powerful, expensive or exotic bikes typically cost more to insure. Anything that increases risk (either in terms of accidents, or cost of repair/replacement) to the insurer will drive up premium costs.

Is motorbike insurance cheaper with a full licence?

Insurers are likely to view you as less of a risk if you have passed your test (whether that be for an A1, A2 or class A bike licence) than if you are riding as a learner on L plates.

Where is the cheapest place to store a motorbike for insurance?

Motorbike insurance will typically be less expensive if you can store the bike on your property and in a locked garage.

To be acceptable to most insurers, the garage will need to be brick built with a concrete base - however some insurers will accept wooden or metal sheds or containers, providing they can be securely locked and with solid/fixed floors. Check with your broker to be sure.

Can I add additional riders onto my motorbike policy?

You can add up to 4 additional riders on the comparison form. You will receive quotes from brokers who allow additional riders - this usually comes at an extra cost.

Can I insure more than one motorbike on a single policy?

Yes – but you will need a special multi bike insurance policy.

You can’t compare multi bike insurance at Biker Insure – the system is for single motorcycle policies only.

Can imported motorcycles be compared?

Although nowhere near as common on the road as during the grey bike boom of the 90s and early 2000’s, insurance for non-official imports can still be compared. You’ll usually see a (grey) denomination against the model.

Some insurers might not be able to provide cover for all non-official imports, but you’ll still see a list of quotes from the brokers who can.

Can I ride other bikes on my insurance policy?

If you have comprehensive motorcycle insurance you might be covered to ride other people’s bikes, but this is usually on a third party only basis.

A Temporary motorcycle insurance policy could provide greater piece of mind for more comprehensive cover if you want to ride other people’s bikes.

Can a car NCB bonus be used on a motorbike policy?

You can only usually accrue NCB on one vehicle at a time. Most insurers won’t allow you to move your NCB from a car to a motorbike, but there may sometimes be exceptions.

What is a motorcycle CBT?

CBT is a Compulsory Basic Training course that you usually need to take before riding a moped or motorcycle on UK roads.

It’s not a pass or a fail - CBT training makes sure you are able to ride safely on your own whilst practicing for the full test.

After you have completed a motorcycle CBT, you can ride a moped if you’re 16 or over, or a motorcycle up to 125cc and 11kW if you’re 17 or over. You’ll need to display L plates and be insured.

You must pass your full test within 2 years, take the CBT again, or stop riding.

What is a motorcycle policy excess?

An excess is the amount of money you’ll contribute towards a claim. Compulsory excess is what you have to pay, and you can choose to add a voluntary excess on top of this (usually to a maximum of £500).

Depending on what level you choose, the price of your policy could be reduced.

You can compare and change the amount of your voluntary excess on the bike quote results page.

Can you compare motorbike insurance anywhere in the UK?

The system compares quotes from UK based, FCA regulated motorcycle insurance providers. The insurers on the panel should usually be able to provide a quote no matter where in the UK you live, including Northern Ireland.

As long as you are a UK resident with a valid motorcycle licence, you can compare quotes. If you haven't lived in the UK continuously or since birth, you'll need to enter the year and month you last became a UK resident.

Can I add a motorbike to my car insurance?

Some insurers offer combined car and bike policies. It's sometimes called "six wheel insurance". This isn't something that the system at Biker Insure can compare, so you will need to approach providers directly.

If you do find a car and bike policy, always check to see if it's any better value than buying individual policies.

What’s the best motorbike insurance company in the UK?

“best” is a very subjective term. Every motorbike insurance company is different. Different prices, different policy structures, add-ons, claims processes and customer service etc. You could visit a review site such as Trustpilot to see what experiences other bikers have had. But at the end of the day, it’s your experience with the motorbike insurance company as an individual that matters most.

You can make a more informed decision by comparing quotes. You won’t see any definitive “who is best” answers, but you will see an objective list of facts for each policy – allowing you to decide which motorbike insurer works best for you.

*51% of consumers who received a quote for Motorbike Insurance through this service provided by Seopa Ltd. in August 2023 were quoted less than £194.60. The price you could achieve is dependent on your individual circumstances.